GROWING MONEY ON PURPOSE

13 Money Lessons Every Parent Needs To Know (And Teach Their Kids)

Updated December, 2023

Disclaimer: Views offered on this website are for informational and general purposes only. It is not intended as personal financial advice. Investment and financial decisions involve inherent risk, which the website owner will not be held liable for, in any way, shape or form. Please consult a licensed financial professional or tax attorney, for legal advice relating to your situation.

For moms and dads bravely taking on the role of family CFO – Bravo! Here are some of my personal money rules to help you get started.

- Live below your means & set spending priorities

- You’re losing money by keeping it in the bank

- Automate your savings

- Be willing to learn how to manage your money

- Start early to take advantage of compound interest

- Build up your emergency fund before investing

- Dollar-cost-average into your investments

- Follow a passive buy-and-hold strategy

- Buy low, sell high – but only for the best stocks!

- Avoid making emotional, time-pressured decisions

- Know your investment strategy and stick to it

- Plan for the future, then learn to let go

- Avoid making financial decisions, too soon after a major life event

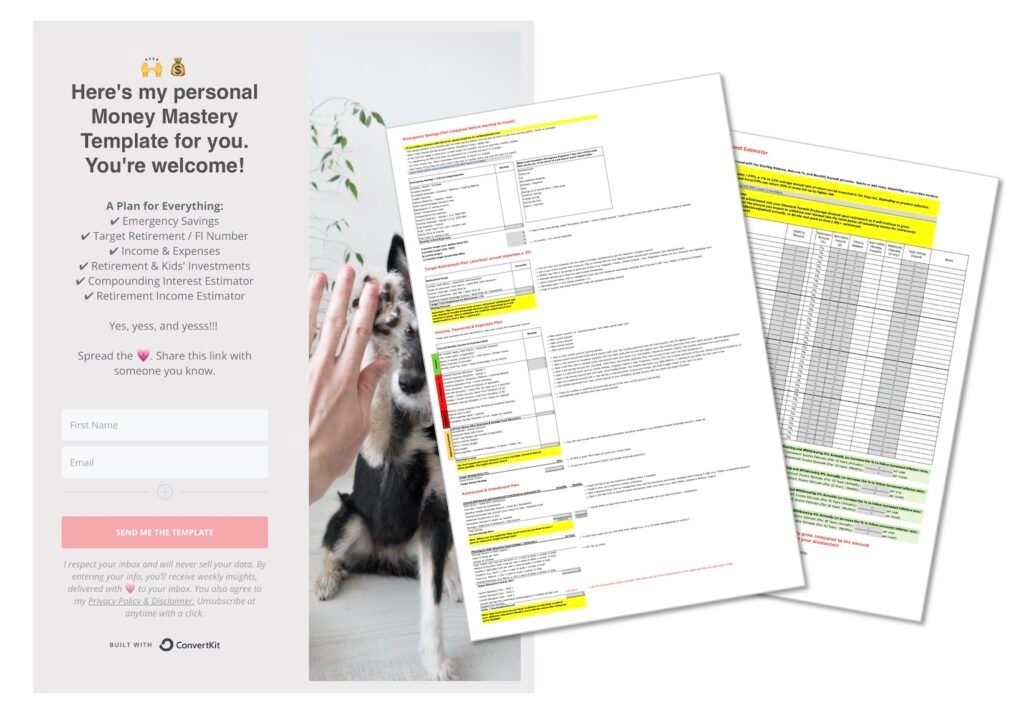

🎁 Download my FREE Money Mastery Template here! 👈👈

1. Live Below Your Means & Set Spending Priorities

This means spending less than what you earn, and learning to prioritize where your money goes.

Start with basic needs such as food and housing, taxes, health insurance, and retirement savings. If your employer offers matching pension plan contributions, take full advantage of it!

How much would you even need, to afford your current lifestyle if you lived till over 90?

These are figureoutable numbers that you can calculate. Or use the rough rule of 👉 aiming for 25 times your annual expenses. Find out if you’re on track to achieve this number before, or at least by retirement.

Beyond the basics, what values and experiences are truly the most meaningful to you?

Is it security, freedom, travel, personal development, being your own boss, time with family and friends, community, a big house, or a fancy car?

Studies show that “things” rarely result in lasting happiness – just some food for thought.

Taking time to get clear and excited about your goals, will be the fuel to keep you going… either to save money, or increase your income (or better yet, both!), to turn your dreams into a reality.

Here are some money-saving rules to consider:

- Your apartment rental shouldn’t be more than one-third of your gross salary.

- Always pay off your credit card bills each month.

- Purchase instead of leasing a car. Get a used one which you can afford to pay off within 2-3 years.

- Consider buying a house only if you plan to live in it forever and can afford to pay it off before retirement (the sooner the better, to avoid interest costs). Your house is an expense, not an investment – if you’re not renting or selling it for profit.

- Before buying, Tiffany Aliche (A.K.A. Budgetnista) asks, “Do I need it, love it, like it, or want it?” If it’s just a like or a want, consider saving your hard earned cash to fund more important goals in your life.

- If you’re a social spender, ask yourself, “If nobody could see it, would I still buy it?”

2. You’re Losing Money by Keeping it in the Bank

So you’ve saved money, but you’ve kept it all in the bank, or in a non-invested retirement account.

Did you know that the value of your money decreases over time thanks to inflation?

For retirement planning, assume a US inflation rate increase of 3% annually, or 2.4% per annum for Switzerland.

If your bank’s offering less than that as interest on your savings, than you’re better off investing it in the stock market. It’s the only investment vehicle that has consistently beat inflation.

The only money that you should keep uninvested and in the bank (preferably in a high-interest account) is:

- your monthly expenses

- money that you need in the next 3 to 5 years

- your emergency fund

Customers beware: If a bank offers extraordinarily high interest rates, check if its to attract new clients. Is the offer only valid for the first year?

3. Automate Your Savings

Money you don’t see, you can’t spend – it’s as easy as that.

Automatically set aside money for taxes, rent, bills, groceries, health insurance, spouse allowance (if applicable), holidays, emergency fund (if underfunded), retirement fund, kids’ college fund, and out-of-retirement-fund investments.

Work towards saving 30% of what you make or more, towards funding your retirement and investment accounts. The more you save today, the faster you’ll reach financial independence.

💰 I talk about basic money lessons, for moms running a household in Episode 12:

4. Be Willing to Learn How to Manage Your Money

This means being aware of of how you think about money, how you make it, spend it, save it and how you grow it.

Be the informed consumer that knows exactly what to ask their financial advisor or bank, instead of expecting them to know what’s best for you.

Nobody cares more about your money than you.

Listen to podcasts, take online courses and read books geared towards educating and empowering the average consumer to manage and invest their own wealth (look out for courses offering lifetime updates).

This avoids hefty fees (above 1%) that most banks and financial managers charge. Here are a handful of resources that I follow:

- Suze Orman – a podcast for US investors, but great for everybody really. Suze and KT have big hearts, speak from experience, and provide investment and retirement advice for the common people.

- Afford Anything – if you’re into the FIRE movement (Financial Independence Retire Early), give this podcast by Paula Pant a listen.

- Millennial Investing – Financial independence podcast for Millennials by Rebecca Hotsko.

- FinanzFabio – from a swiss-german speaking young investor and financial planner. FinanzFabio and Gabor Gaspar further explain the benefits of investing the Swiss pension pillar 3a, on this YouTube video.

🆘 Need help avoiding common pitfalls and money arguments? Tune in to Episode 12:

5. Start Early to Take Advantage of Compound Interest

Otherwise known as the “snowball effect,” compound interest is when you generate “interest on the interest” that you’ve earned in your savings or investments.

LESSON: reinvest your dividends.

Compounding multiplies your money at an accelerated rate (if you plot it out in a graph, you’ll see that the compound interest curve increases at an increasing rate). That means that the earlier you start to invest, the longer you can leave it to compound, and the more your money is able to multiply on itself.

At some point, your compounded interest can be even higher than the principle amount you’ve invested.

Isn’t that cool?

📈 How much would you money grow over time if you invested a few hundred dollars a month instead of keeping it in your bank account?

📌 Check it out for yourself! I’ve listed two calculators for you to play with below. How much would you need to save and invest each month to fund your retirement or your kids’ education (or braces?). It’s a super powerful tool that puts you in the driver’s seat:

- MoneyGeek’s Compound Interest Calculator (nice visuals)

- Suze Orman’s Compound Savings Calculator (click ‘view report’)

Which rate of return % should you use? As a guide, the average annual rate of return of the S&P 500 (widely used as a benchmark) over the past 50 years has been about 11%, or 7.5% inflation adjusted… 👈 You can use the lower number to be prudent.

Yes. Individual blue chip growth stocks like AAPL or GOOGL can have an annualized return of 30% or more (let me know if you find a better estimate). But they also carry more risk and require you to monitor the health of the company once in a while. Would they still exist in 15 to 30 years time? …Who knows?

6. Build up Your Emergency Fund before Investing

This could be 8 months’ to 1 year’s worth of living expenses in the US, or 3 to 6 months’ worth of living expenses in Switzerland due to the country’s more robust unemployment system. Only invest after or at least while you build up your emergency fund. This protects you from having to sell your investments to cover unexpected costs, when the market is on a down cycle.

Remember, a win or loss is never realized until you actually sell, and your risk of loss decreases over time (3 years or more).

7. Dollar-Cost-Average into Your Investments

Yup, I’ve made the mistake of putting a big lump sum of money into the market as an impatient newbie investor. Instead, I should’ve dollar cost averaged it. This means splitting the total amount that you want to invest into smaller portions, and investing it over the course of a few months.

Look for discount brokers where you can automatically invest on a monthly basis, and only invest money you don’t need in the next 12 months.

According to Warren Buffet, widely considered the most successful investor of all time – if you have five or more years to add money into the market, you should prefer to see stocks fall.

This is because the money that you dollar cost average (DCA) into the market will be able to buy more shares at discounted prices.

My advice: just be sure to buy globally diversified ETFs or shares of large cap growth companies – instead of small ones, that can fail during a big recession.

8. Follow a Passive Buy-and-Hold Strategy

Slow and steady wins the race. Consider investing long-term in low cost index funds or ETFs which track the market like the S&P 500, VTI, VOO, SCHD, VT or VWRD (fund availability dependent upon your location). Buy your stocks directly through your pension fund, a cheap online broker or robo-advisor.

Compare and be aware of transaction, foreign exchange and management fees (if any). Don’t go over 1% in total fees – less is always better. Those percentages add up as your investment grows!

9. Buy Low, Sell High – But Only For The Best Stocks!

If you have extra money to side aside (like from a bonus or extra income), consider holding it for a limited time in your brokerage account, to take advantage of the market when it’s down.

This means buying when the market is fearful and funds or stocks are selling below its average P/E Ratio (making it cheap or undervalued). Check the average P/E Ratio of individual industries, as they vary.

Yes this IS considered timing the market, which I generally disagree with. But there are nuances.

When markets are tanking, even the best stocks can sell at bargain basement prices. So it’s a good idea to take advantage of this and buy more if you can. But as a caution, ONLY stockpile stocks or ETFs in a recession, that you would still like to own in the long run, even when the market recovers.

This way, you help you money compound for you at a higher rate when the market recovers.

To reduce risk, only invest in established funds with a volume of above 100 million, and individual stocks with a market capital of above 20 billion.

10. Avoid Making Emotional, Time-Pressured Decisions

Stay away from influencers and scary news pundits that get you riled up over the latest market trends, or ones that promise you a super high return if you only invest NOW!

Keep in mind that financial professionals can have internal incentives to ‘influence’ you to buy or sell, and online investment articles are often written to get the most clicks. Binge read, and you’ll quickly find contradictory recommendations enough to make your head spin. Nobody knows how the market will perform, despite past performance and future expectations.

I recommend finding just a few voices that you feel you can trust (and not just faceless establishments), to help you feel secure in forming your own personal money strategy.

The truth is that higher returns equals proportionately higher risk. It’s actually healthy for the stock market to go up and down. To grow and to self-correct – expansion, peak, recession, recovery. Although it might seem nice, a continuous upward trend in anything is never sustainable (hello financial bubble!). Just trust that historically, the stock market always had more up years than down ones. So, simply dollar-cost-average and stop worrying about it.

11. Know Your Investment Strategy and Stick to it

Discover your risk tolerance and always know why you‘re buying something. For instance, “I’m only going to invest in one globally diversified fund and dollar-cost-average into it every month. That’s it.”

Or… “I’m Investing 80% in ETFs or funds, and 20% in individual stocks.” Or… “My investment in individual stocks will be equally split between growth, value and dividend paying stocks.”

It might sound complicated, but let the knowledge layer on slowly, over time. Everyone can start (and even stay invested!) very simply with a single diversified index fund or ETF. You’ll find your preferences. Just keep learning by doing. You can do this!

My tip: Research ahead of time what you want to buy, and set a target “limit price” before purchasing a new investment. Begin by picking ONE diversified ETF or fund that you like, and learn by making some comparisons.

📈 Fear still holding you back? I discuss some common misconceptions about investing in Episode 13:

12. Plan for the Future, then Learn to Let Go

Do your best to plan for the future, but learn to let go of the outcome and the things that you can’t control. Find your happy middle.

Save what you can, contribute to an invested pension plan, take full advantage of your employer match if offered, and invest most of your money in diversified index funds and ETFs.

Additionally, take the time to ensure that you have the following documents prepared according to local laws, so your loved ones stay protected:

- Last Will and Testament, including Executor

- Living Revocable Trust (availability dependent on country)

- Financial Power of Attorney

- Durable Power of Attorney for Healthcare

- Advanced Care Directive

For US residents: Check out Suze Orman’s Must-Have-Documents bundle. It often comes on sale, if you follow her podcast.

For Swiss residents: Templates can be found online. Here are some quick links for you to check out ( let me know if you find better resources).

- Succession Information

- Wills and contracts of succession

- Living Will / Advance Care Directive

- DeinAdieu’s free Will and Advance Care generator

Regarding children… Please refer to local inheritance laws regarding assets left to underaged children, if you have any. Often those assets will be blocked until the child reaches legal age. If you have a loving and secure relationship with your spouse, consider leaving your assets to him/her, so it can be easily accessed and used to support your family in the event of your passing.

Growing Wealth Beyond Retirement

Imagine your future self… You’ve reached your retirement age and now need to start extracting your mandatory retirement funds.

- What will you do with it?

- Where will you keep it?

- How much can you spend?

- How many years will it last you? (…assuming you live till 85)

- Should you re-invest it in the stock market? (YES!!!)

Personal finance author Andrew Hallam, estimates in his book Balance, that this strategy should allow retirees to make their money last for at least another 30 years!

Trust that you will problem solve this:

- You could decide to continue working part time doing something you love, to keep earning.

- You could retire in a lower cost location to keep expenses low.

Which incidentally helps you reach your investment goals sooner, instead of spending time trying to outsmart the market – and losing.

13. Avoid Making Financial Decisions, Too Soon After a Major Life Event

This includes decisions on investments and real estate. Major life events include divorce, or the death of a loved one. Suze Orman advises everyone to wait at least one year to grieve and settle down, before making any financial moves.

Here’s a VIAC promo code (my recommended Pillar 3a solution) for Swiss Investors – to get a lifetime offer to manage your first CHF 1’000, for free. Use the code: yW1wTNC

Open an account with Interactive Brokers (my discount broker of choice), to receive a free IBKR welcome stock when you use our family’s referral link here.